Enrolled Agent Exam Review

Become a Tax Expert, Authorized by the IRS

About the EA Credential

An Enrolled Agent (EA) is a skilled tax practitioner granted the legal authority to represent clients in their tax matters before the Internal Revenue Service (IRS). This includes handling IRS communications on the client's behalf, appealing decisions, and providing assistance during audits. Becoming an Enrolled Agent requires passing the comprehensive, three-part EA Exam. This test assesses your ability to represent clients on various tax topics and covers:

- Part 1: Individual

- Part 2: Business

- Part 3: Representation, Practice, and Procedures

Learn about the steps needed to become an EA.

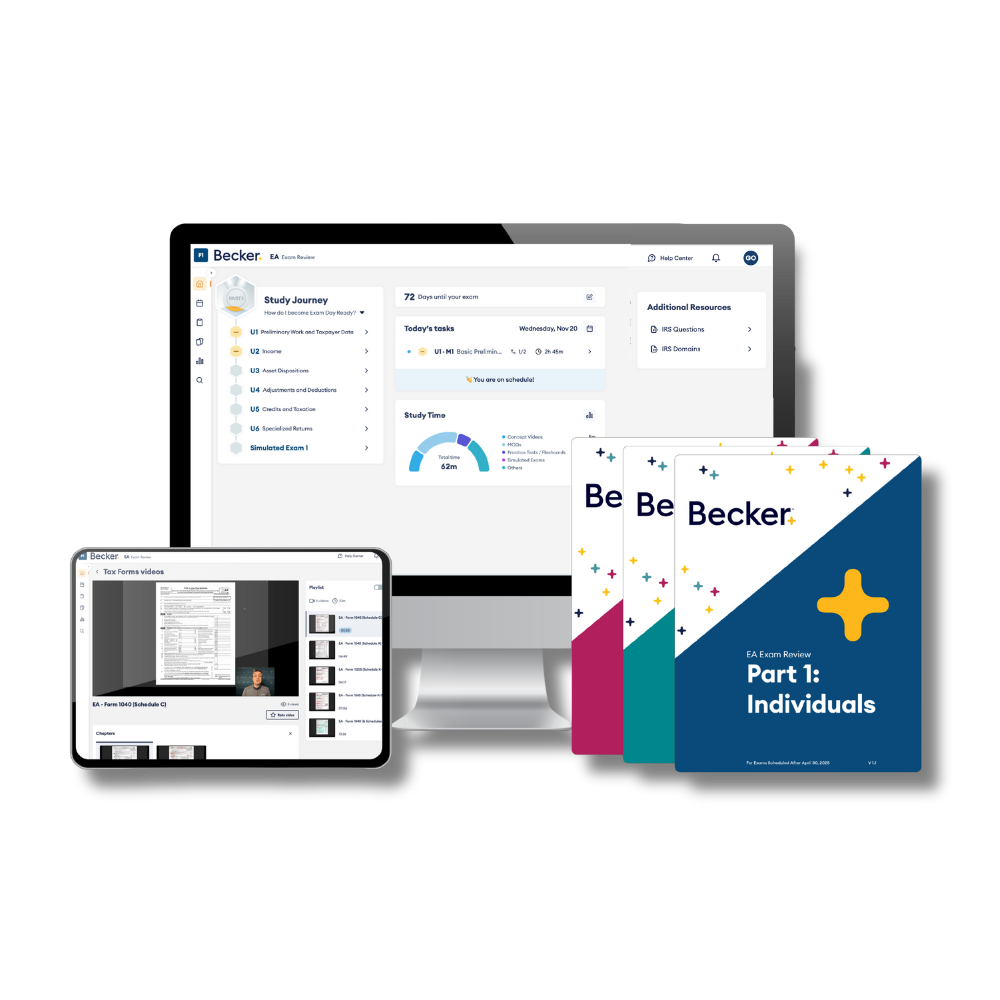

EA Exam Review Packages

Everyone’s journey to prepare for the EA Exam is unique. Whether you choose the Essentials or Pro package, we have the right tools to support your success.

EA Review Pro

EA Review Essentials

Results-Driven EA Training

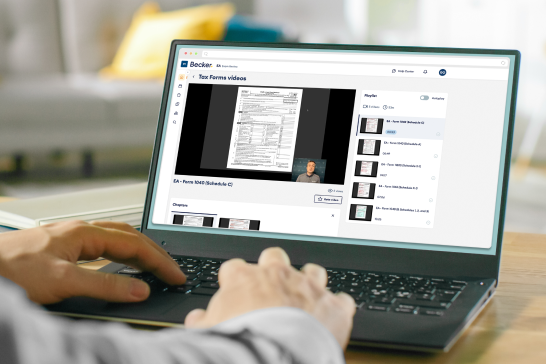

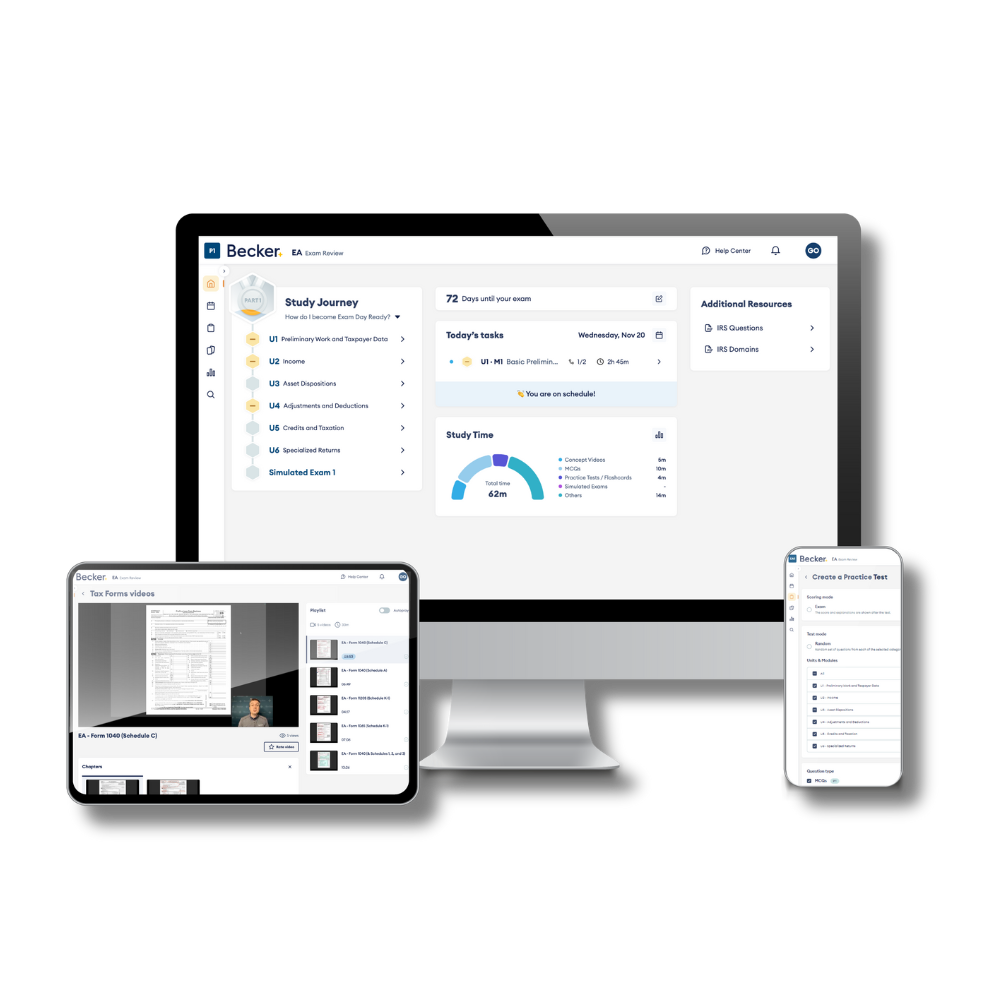

Updated content taught by expert industry leaders

Personalized study planner

Proven study tools to help retain information

Simulated exams

Unlimited, customized practice tests

Requirements ...

- Education: No formal education is required by the IRS. However, a strong understanding of tax concepts, laws, and regulations is expected, and many EAs have a background in finance or accounting.

- Exam: You must pass the EA Exam.

- Experience: No specific work experience is required by the IRS, although many EAs have prior tax or accounting experience.

- PTIN: You must obtain a Preparer Tax Identification Number (PTIN) before beginning the process.

Free Resources

Exam Essentials

The EA Exam includes three separate parts that you must pass within a maximum three-year period: