Many investors nowadays are trying to figure out how to match their values and financial objectives. As a result, interest in sustainable investing—which includes a range of strategies—has increased dramatically. ESG and SRI are two terms you’ll likely hear used frequently. But what do they actually imply and are they interchangeable?

A Methodology to Consious Investing in SRI

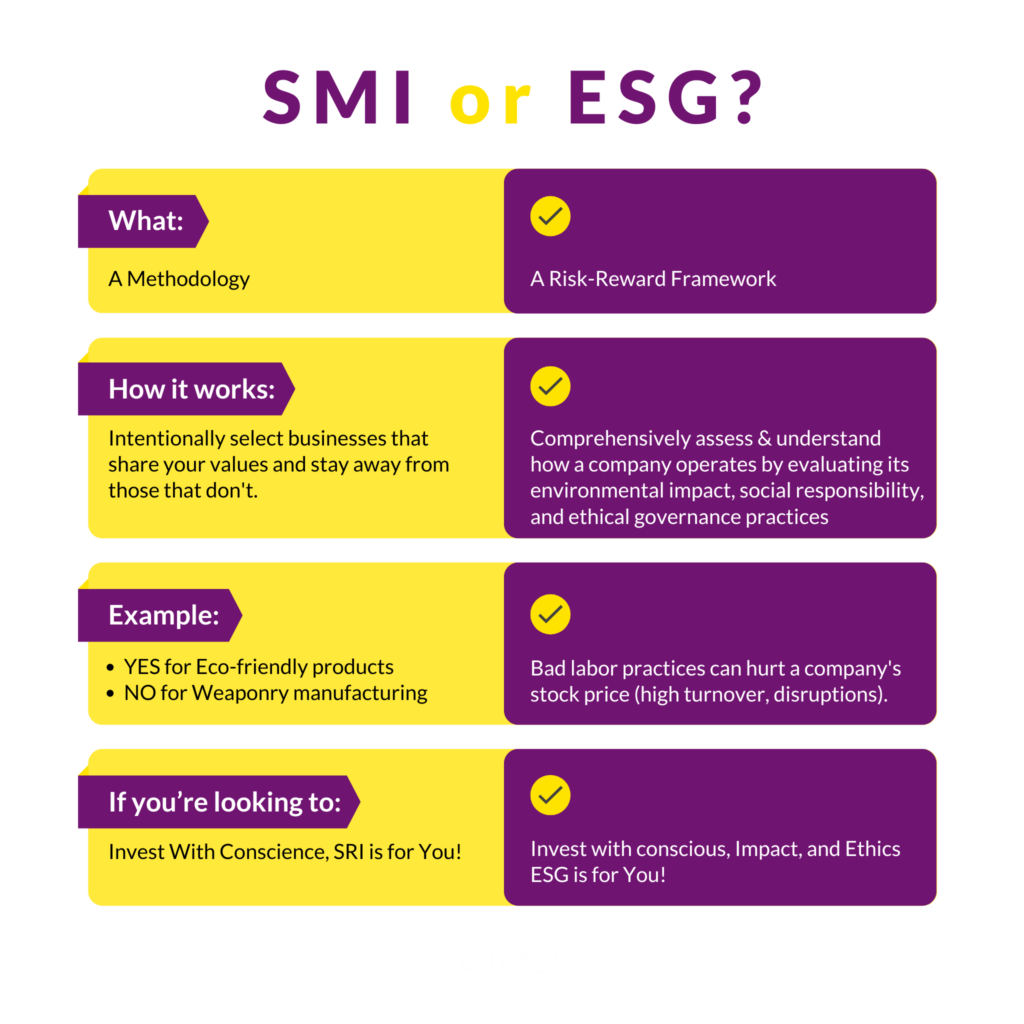

Aligning values with investments is known as socially responsible investing, or SRI. SRI is a well-established methodology that centers on the moral ramifications of investments. Generally, SRI investors exclude businesses engaged in activities they deem detrimental, such the manufacture of weaponry, tobacco products, or fossil fuels. On the other hand, people might give preference to businesses that exhibit environmentally and socially responsible activities.

Think of SRI as investing with a conscience. You intentionally select businesses that share your values and stay away from those that don’t.

An Approach to Risk-Reward in ESG Investing

Environmental, social, and governance, or ESG, considerations are a more comprehensive framework for evaluating a business’s sustainability initiatives. ESG factors take into account a company’s overall corporate governance structure, its interactions with employees and communities, and how it manages its environmental impact.

The main difference is that ESG investment doesn’t always entail eliminating certain companies. Rather, it’s about comprehending how a company’s financial performance might be impacted by ESG factors. For instance, a business with poor labor standards may have increased staff turnover and business interruptions, both of which could be detrimental to the value of its stock.

So, SRI vs. ESG: Which One is Right for You?

When looking to have a good influence, investors can find both SRI and ESG to be useful tools. Here’s a brief summary to assist you in selecting the strategy that best fits your objectives:

Select SRI if: You feel at ease leaving out specific sectors of the economy or companies, and you place a high priority on matching your investments with your ideals. Select ESG if: You’re looking for a more thorough approach that takes into account the opportunities and financial risks associated with sustainable initiatives. In the end, a hybrid strategy might be the most effective. After compiling a shortlist of possible investments using ESG considerations, you can use SRI standards to narrow the field and make your final decisions.

The Conclusion

Knowing the differences between SRI and ESG, whether you’re an experienced investor or just getting started, can help you make decisions that align with your social and financial objectives. You can possibly get substantial returns while simultaneously making a beneficial impact on the future by integrating sustainable concerns into your investment strategy.