Imagine the Netherlands in the 1630s, a global economic powerhouse. The nation is swept up in a bizarre, beautiful craze: the tulip.

Initially a status symbol for the elite, this exotic flower quickly becomes a full-blown speculative mania. Prices for rare bulbs soared to more than ten times the annual income of a skilled artisan. The most prized varieties, marked with unique patterns by a mosaic virus, were treated as priceless art.

The Seed of a Speculative Frenzy

The fever broke all social boundaries. Everyone from wealthy merchants to chimney sweeps plunged into the market, trading contracts for bulbs that hadn’t even bloomed yet. This “wind Handel,” or “paper trade,” detached prices from any real-world value, with a single bulb trading for more than a grand Amsterdam mansion at its peak.

The Inevitable Collapse

The bubble reached its peak in the winter of 1636–1637, but the collapse was swift and shocking. A routine auction in Haarlem failed to find a buyer, shattering confidence and sending prices plummeting almost overnight. Bulbs that were once worth a fortune became worthless, leaving countless speculators bankrupt. While the crash did not devastate the entire Dutch economy, the psychological and social damage was immense.

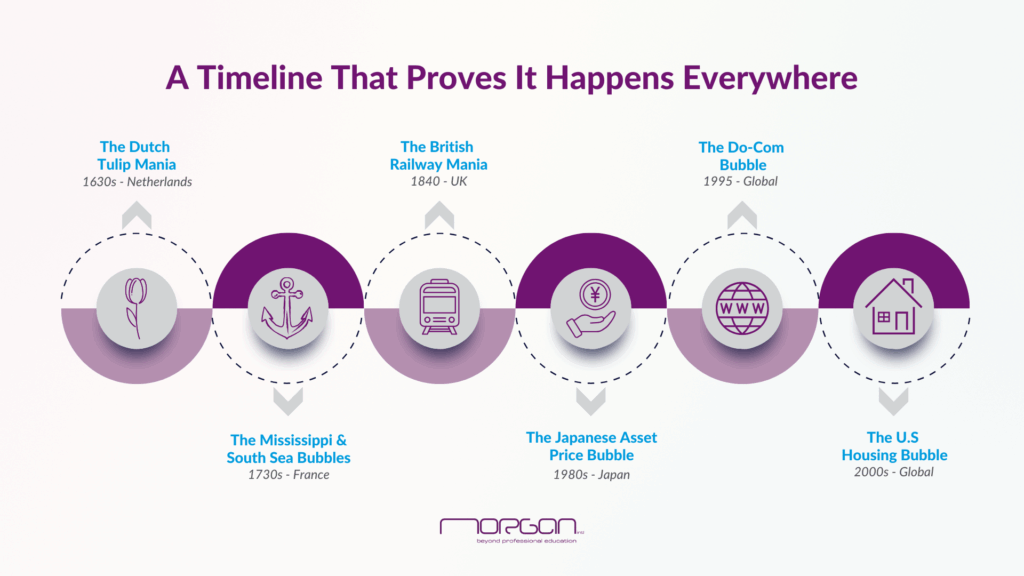

A Global History of Pitfalls

Takeaways for the Modern Investor

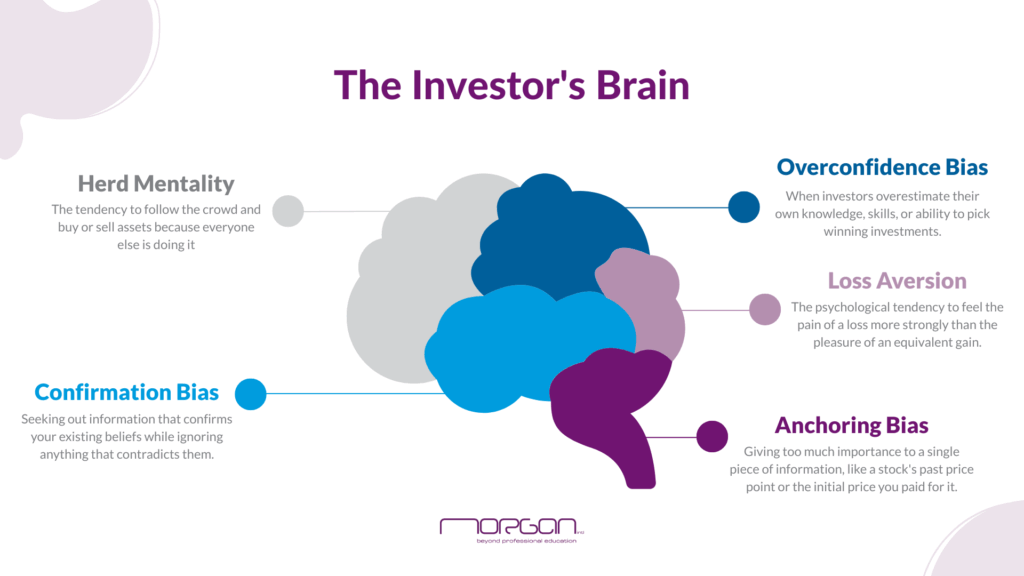

The story of Tulip Mania is not a tea-time story; it is a profound lesson in behavioral finance, a field that studies how psychological factors influence financial decisions. The Dutch tulip bubble reveals timeless truths about investor behavior that are just as relevant today.

Here’s what the tulips can teach us:

- The Danger of Speculation. The tulip market was driven purely by speculation, with prices far exceeding the bulbs’ intrinsic worth. This is a stark warning about the risks of investing in assets that have no real underlying value or productive potential, a pattern repeated in many modern crazes.

- Herd Mentality Fuels Bubbles. People bought tulips simply because everyone else was getting rich. This “herd mentality” is the engine of “irrational exuberance,” where investors copy the crowd without independent research, often leading to self-perpetuating bubbles.

- Emotional Decisions Destroy Discipline. The market was fueled by the fear of missing out (FOMO) and the false belief that prices would rise forever. When the market turned, panic selling took over, illustrating how emotional decisions lead to costly mistakes and a complete breakdown of a sound financial plan.

- Leverage Amplifies Risk. Many tulip traders borrowed heavily to invest, hoping to repay their loans with future profits. When the market collapsed, they faced financial ruin. This highlights the immense risk of using leverage, as it can magnify both gains and losses.

The Psychological Pitfalls of Investing

The Enduring Lesson

The story of the tulips may be from the 17th century, but the lessons it holds are anything but old. While the way we invest has changed dramatically, from trading paper contracts in taverns to using apps on our phones, the psychological forces that drive market bubbles have not. They are timeless.

Greed, the fear of missing out, and the rush to follow the crowd are the same emotions that fueled the Dutch tulip craze, the dot-com bubble, and every speculative frenzy in between. As you consider your next investment, ask yourself a simple question: Is this a lasting asset with real value, or is it just another tulip bulb?

#MorganIntl