Investment decisions often seem purely analytical, driven by data, models, and forecasts. But let’s be honest: Are they really? The reality is far more complex. Investor psychology is a deep endeavor where human emotions frequently clash with rational analysis, leading to predictable, often costly, errors.

Investing often feels analytical, driven by data and models. But is it? Investing is deeply psychological; emotions often clash with rational analysis, leading to costly errors. Traditional finance assumes a ‘rational economic man,’ but real-world behavior differs. Behavioral finance (BF) merges investor psychology and finance to understand how biases and emotions actually shape decisions. Acknowledging this ‘human element’ is critical.

Let’s explore two common pitfalls—Fear of Missing Out (FOMO) and Loss Aversion—through the disciplined lens of frameworks like the Chartered Financial Analyst Program.

The CFA Lens on Investor Behavior: Why Psychology Matters

The CFA Program curriculum stresses that understanding investor psychology is a practical necessity. How?

- Integrated Concepts: Behavioral finance is woven into portfolio management, asset allocation, and client interaction

- Practical Application: Recognizing biases helps align portfolios with client goals and psychological limits.

- Evolving Skills: New Practical Skills Modules (PSMs) embed behavioral insights into core competencies.

Mastering behavioral finance means applying principles to improve decision-making and client relationships.

Beware the Siren Song: Fear of Missing Out (FOMO)

Ever felt anxious that others are profiting while you’re not? That’s FOMO. Often amplified by social media, it triggers impulsive “bandwagon jumping.”

What are the consequences of this lack of thorough examination?

- Lack of analysis

- Buying high

- Ignoring fundamentals

- Short-term focus over long-term strategy

FOMO links to herd behavior—mimicking the group, abandoning judgment. It stems from greed, fear of relative loss, and avoiding regret.

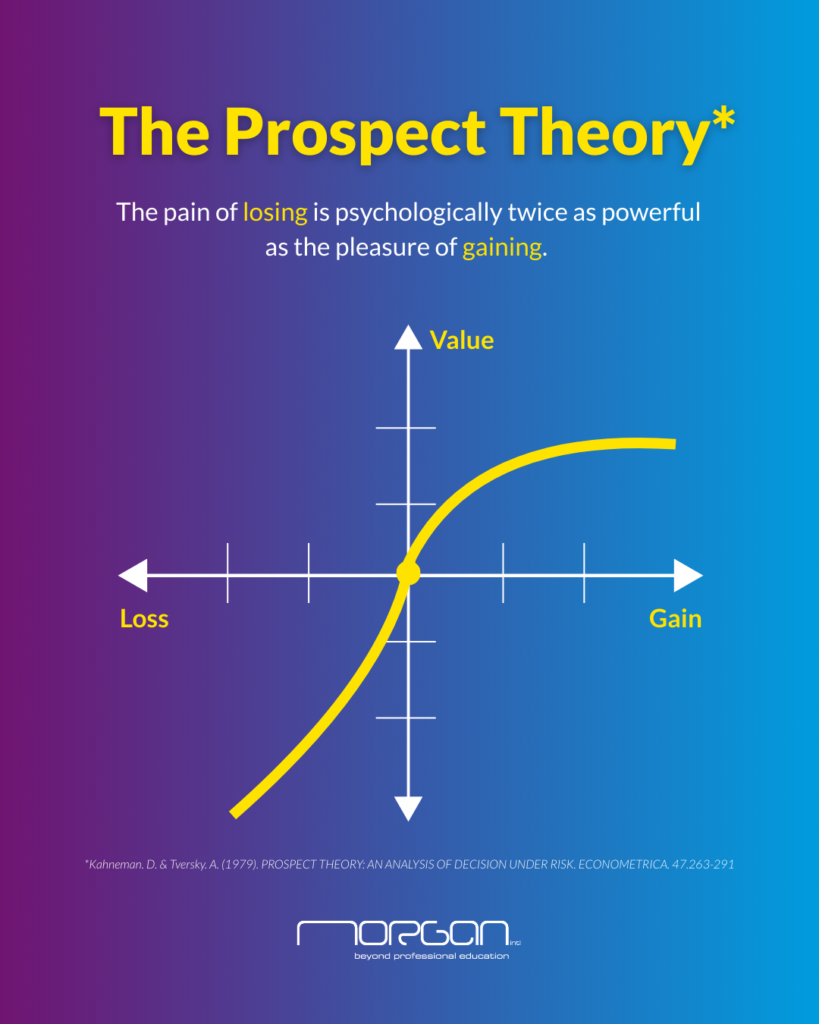

The Pain of Loss: Understanding Loss Aversion

Which feels worse: losing $100 or gaining $100? Most feel the loss more intensely. This is loss aversion, pioneered by Kahneman and Tversky. Losses feel psychologically about twice as powerful as equivalent gains.

How does this affect investing?

- Disposition Effect: Holding losers too long, selling winners too soon.

- Inconsistent Risk Taking: Risk-averse with gains, risk-seeking with losses.

- Emotional Anchoring: Fixating on purchase price.

Loss aversion leads to suboptimal returns and flawed risk management. Effective management requires focusing on future prospects, not past prices.

Forging Discipline: Strategies from a CFA Perspective

Combating biases requires a disciplined investment process, central to the CFA Program. How?

- Acknowledge Biases: Awareness is the first step.

- Build & Stick to a Plan: A defined plan based on goals, risk tolerance, and analysis is your defense against impulse.

- Reframe Risk: Goals-based investing focuses on long-term objectives, not short-term volatility.

- Diversify: Spreading investments manages risk and counters herd behavior.

- Seek Objective Feedback: Challenge your views with diverse perspectives and advisors.

- Keep Records: Document decisions and rationale to learn from mistakes and combat hindsight bias.

These strategies impose process discipline (System 2 thinking) over emotional impulses (System 1).

Sharpen Your Edge with Morgan International

Mastering investor psychology is integral to the CFA Program and investment success. As practical skills gain importance, how can you prepare?

Morgan International, partnering with Kaplan Schweser, provides expert CFA exam preparation. We focus on both knowledge and practical application. Our methodology helps you:

- Master the Curriculum: Deeply understand all topics, including behavioral finance.

- Develop Practical Skills: Bridge theory and real-world application, including navigating client biases.

- Build Exam Confidence: Utilize practice tools, mock exams, and expert support.

- Learn Flexibly: Choose Live Classes*, Live Online, or Self-Study formats.

Investing in your CFA journey with Morgan International means investing in understanding markets and minds.

*Live Classes are only available in specific locations

Conclusion: The Disciplined Investor’s Edge

Long-term success hinges on mastering market analysis and your own investing psychology. Emotional discipline, fostered by understanding biases—a journey encouraged by the CFA framework—provides a distinct advantage. The edge often comes less from superior analysis and more from superior behavior, enabled by self-awareness and process discipline.

Are you ready to embrace this discipline?

#BehavioralFinance #InvestorPsychology #FOMO #LossAversion #CFA #MorganIntl